Your Daily Best of AI™ News

🚨GTMfund rewrites the distribution playbook for AI startups as product development becomes commoditized, arguing that distribution excellence—not better models—is the actual moat forcing complete rethinking of go-to-market strategy when anyone can build competitive AI products but few can scale customer acquisition profitably.

The Big Idea

ChatGPT's $25 Billion Ad Play: When Your AI Confidant Becomes a Salesman

Ask ChatGPT how to treat a headache, and soon you might get an Advil ad embedded in the answer. Ask about marathon training, and it could recommend specific running shoes—for a commission.

OpenAI is exploring ads inside AI-generated responses, creating a new, highly contextual channel for reaching users at the moment they seek information. With over 800 million weekly active users and mounting infrastructure costs exceeding $1.4 trillion in commitments, OpenAI is exploring multiple ad-driven revenue models to fix a brutal economic reality: the company is burning billions with no profit in sight until 2029.

This isn't just another tech company adding ads. It's the monetization of intimacy at scale.

The Economics Forcing This Decision

The numbers tell the story. Only approximately 5% of this massive user base subscribes to paid plans—roughly 35 million users paid for ChatGPT Plus ($20/month) or ChatGPT Pro ($200/month), with an additional 2 million business customers using enterprise and API services. This means that 95% of ChatGPT's users consume computational resources without generating direct revenue—a fundamentally unsustainable model.

Meanwhile, the company generates between $3.5 and $4.5 billion in revenue annually but spends more than $8.5 billion. Analysts predict the company will post a $5 billion loss over the next 12 months.

The math is brutal: OpenAI needs money. Fast. And with 800 million weekly users, ads are the obvious answer.

How It Works:

According to reporting from The Information, OpenAI has begun exploring ad formats and partnerships, with early discussions pointing toward ads that could appear within or alongside AI-generated responses.

Intent-based monetization: OpenAI's ad strategy has been labeled internally as "intent-based monetization," and instead of just providing answers to people's questions, ChatGPT may evolve to start making recommendations on occasion. Ask about running a marathon? ChatGPT will provide training advice—and suggest a local running clinic or specific brands.

Sponsored priority: One conversation between OpenAI staffers involved giving sponsored chatbot results "preferential treatment" over non-sponsored results. This could look like a user asking how much ibuprofen to take for a headache receiving a promoted ad for Advil in the chatbot's response.

Generative ads: OpenAI is exploring "generative ads," where ChatGPT basically creates the ad itself, choosing which specific features of a product to mention. It would experiment with different ways of pitching products to try to increase conversion rates.

Visual placement: Recent mockups leaked from OpenAI's development process show sponsored information displayed in a sidebar next to the main ChatGPT response window.

The infrastructure is already being built. The ChatGPT Android app beta included references to an "ads feature" with "bazaar content," "search ad," and "search ads carousel."

What Makes This Different (and Lucrative)

Google knows what you search for. Meta knows what you like. But ChatGPT? GPT likely knows more about users than Google. It knows your writing style, your problems, your ambitions, your fears—the questions you're too embarrassed to Google.

It could monetize by showing ads based on the treasure trove of information it has on users, by mining their chat histories. That's not demographic targeting—that's targeting based on your entire inner monologue.

As advertising becomes more embedded and less transparent, users may find it harder to distinguish ads from genuine content, raising concerns about autonomy, data privacy, and the ethical implications.

The Revenue Opportunity

OpenAI projects that up to 20% of future revenue could come from advertising-related features, including both direct ads and sales commissions. With the company targeting $125 billion in annual revenue by 2029, this advertising segment could represent a $25 billion business in its own right.

To put that in context: the value of the global advertising industry is expected to reach $1 trillion annually this year or next. OpenAI wants a serious piece of that pie—and it's looking at its AI model-developing competitors Meta and Google, which are pulling in hundreds of billions of dollars per year in advertising revenue.

The company has been laying groundwork through strategic partnerships. Content licensing deals include The Washington Post (April 2025), Dotdash Meredith (publications including Investopedia, People, and Better Homes & Gardens), Condé Nast (Vogue, The New Yorker, Wired), and The Walt Disney Company ($1 billion licensing agreement in December 2025)—relationships that could easily evolve into advertising channels.

OpenAI has recently hired several C-level executives who all have an impressive pedigree from ad tech teams at X, Meta, Instagram, and Google.

The Trust Gamble

An OpenAI spokesperson told The Information: "People have a trusted relationship with ChatGPT, and any approach would be designed to respect that trust."

But that trust is precisely what makes this so valuable—and so risky. Some ChatGPT users have already been critical of a shopping feature which they said made them feel like they were being sold to. The feature was temporarily removed in December 2025.

CEO Sam Altman tasked the nascent ad team with ensuring that any ads in ChatGPT are just as helpful as the organic responses it generates. If every single response ends up pitching a product or a service, users are going to get annoyed very quickly.

One ad mockup showed ads only appearing after a second prompt with ChatGPT, to avoid bombarding users with sponsored content too early in their conversations. It's restraint—for now. But restraint has a way of disappearing when you're burning billions and need to hit $125 billion in annual revenue.

What's Next?

It's unclear when OpenAI ads will roll out, but observers wouldn't be surprised if they happen in the first half of 2026. Internal conversations suggest ads are becoming a more serious part of OpenAI's long-term revenue strategy.

The bigger question isn't when ads arrive—it's whether OpenAI can pull off what no platform has managed before: ads that feel helpful rather than intrusive in a space where users share their most private thoughts.

With Google recently telling advertisers it plans to bring ads to Gemini next year, and with OpenAI burning through truckloads of cash, the pressure to follow suit is growing. The AI ad race is on.

BTW: Only about 2.1% of ChatGPT queries are clearly about buying a product, according to OpenAI. Which means 97.9% of conversations—the career advice, relationship questions, mental health check-ins, creative brainstorming—are currently ad-free territory. The question is how long that lasts when there's $25 billion on the table.

Create AI Ads From Start to Finish

Have an ad concept ready but don't want to deal with expensive shoots or stock footage? ScriptKit lets you generate, curate, and edit AI ads in one platform.

What ScriptKit gives you

Generate — Create images with multiple AI models (Nano Banana, Reve) and turn them into videos with Veo 3.1 or Sora 2 Pro. Get 3 variations per prompt.

Curate — Review all your generations in one place. Select your best assets, organize by scene, and build your storyboard.

Edit — Arrange clips on a timeline, add captions, adjust timing, and export your polished AI ad in multiple formats.

Give ScriptKit a shot — go from concept to finished AI ad without wrangling teams or gear.

Today’s Top Story

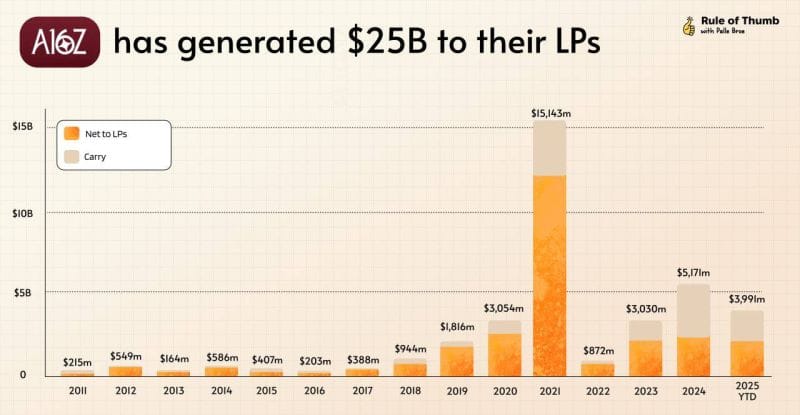

a16z raises $15B, capturing 18% of all 2025 US venture capital

The Recap: Andreessen Horowitz announced it raised more than $15 billion across five new funds—the firm's largest fundraise ever—representing over 18% of all venture capital dollars allocated in the United States in 2025 and bringing the organization to more than $90 billion in assets under management, putting it neck-and-neck with Sequoia Capital as the largest venture firm in the world. The massive haul comes as U.S. venture fundraising hit its weakest year since 2017 with just $66.1 billion raised compared to $101.3 billion in 2024, signaling that capital is consolidating around dominant intermediaries rather than distributing across the ecosystem. Co-founder Ben Horowitz framed the raise explicitly as geopolitical competition: "The technology landscape that we will be investing into is...intensely competitive with China...At this moment of profound technological opportunity, it is fundamentally important for humanity that America wins," revealing how AI funding has become inseparable from national security positioning.

Unpacked:

The fund allocation reveals a16z's strategic thesis. The largest single fund is $6.75 billion for growth-stage investments, indicating the firm believes value capture happens at scale rather than early-stage innovation. Infrastructure gets $1.7 billion, apps receive $1.7 billion, American Dynamism (defense, housing, supply chain) receives $1.176 billion, biotech gets $700 million, and a cryptic $3 billion goes to "other venture strategies" including separately managed accounts for family offices and wealthy individuals seeking tech exposure. The allocation suggests a16z is building a full-stack capital deployment machine covering seed through growth, infrastructure through applications, and commercial through national security—positioning itself as the inevitable intermediary for any serious tech company at any stage.

The consolidation dynamics are winner-take-most. While overall U.S. venture fundraising collapsed 35% year-over-year, a16z captured nearly one-fifth of the entire market. This concentration mirrors what's happening in AI model development: a handful of players with massive resources pull away from the pack while smaller firms struggle to raise meaningful capital. The distribution of LP capital follows power law dynamics—institutional investors like CalPERS (**$400 million** committed in 2023) and sovereign wealth funds including Saudi Arabia's Sanabil Investments prefer betting on proven mega-funds rather than diversifying across emerging managers. This creates a self-reinforcing cycle where a16z's scale advantage attracts more capital, which enables bigger bets, which produces more wins, which attracts more capital.

The political entanglement is strategic, not incidental. Marc Andreessen has spent considerable time at Mar-a-Lago post-Trump election victory, helping shape policy on tech and economics while working as an "unpaid intern" at Elon Musk's Department of Government Efficiency, vetting candidates not just for tech roles but for Defense Department and intelligence agency positions. Scott Kupor, a16z's first employee, was sworn in as Director of the U.S. Office of Personnel Management. This isn't lobbying—it's structural integration into government decision-making that shapes procurement, regulation, and industrial policy. When a16z backs defense tech like Anduril or AI infrastructure plays, the firm has direct influence over the policy environment determining which companies win contracts and regulatory approval.

Bottom line: Andreessen Horowitz's $15 billion raise isn't just a fundraising milestone—it's evidence that AI-era venture capital is consolidating into a kingmaker model where a handful of mega-funds control the majority of deployment capital, leaving smaller firms and independent capital sources increasingly irrelevant. The geopolitical framing around China competition provides ideological cover for capital concentration, but the practical effect is that American AI innovation will increasingly flow through a single intermediary with deep ties to government, sovereign wealth funds, and political power centers.

Other News

Anthropic blocks third-party use of Claude Code subscriptions, signaling shift toward platform lock-in as AI capabilities become exclusive service moat rather than commoditized resource—forcing developers to access Claude directly rather than through wrapper products that commoditize the API layer.

OpenAI acquires Convogo executive coaching AI team, revealing consolidation strategy where AI companies absorb vertical applications to build defensible business models beyond base model layer—talent acquisitions that signal which use cases foundation model providers see as strategic.

Cyera hits $9 billion valuation just six months after $6B valuation, demonstrating infrastructure and security around AI systems have become more critical—and lucrative—than models themselves as enterprises prioritize data governance over model performance.

X restricts Grok image generation to paying subscribers after AI-generated CSAM scandal, revealing how safety failures are forcing companies to monetize restrictions—turning liability management into revenue models when free access creates existential legal risk.

Governments grapple with non-consensual AI-generated nudity flood on X as global regulatory responses signal shift from AI governance to enforcement—creating new legal and compliance costs for platforms that failed to implement safeguards before deployment at scale.

European Commission issues call for evidence on open source sustainability, signaling impending regulation that could reshape how companies build AI systems and licensing models as regulators question whether current open source economics can support critical infrastructure.

Sopro TTS releases 169M parameter model with zero-shot voice cloning running on CPU, demonstrating efficient models on commodity hardware are decentralizing AI capabilities and eroding GPU infrastructure moat as what was cloud-exclusive becomes edge-deployable.

Anthropic adds Allianz to enterprise wins, signaling AI's business value is shifting from chat interfaces to autonomous decision-making systems as agent-building capabilities unlock fundamentally different use cases beyond conversational AI that drive measurable ROI.

AI Around The Web

Test Your AI Eye

Can You Spot The AI-Generated Image?

Prompt Of The Day

Copy and paste this prompt 👇

"I want you to act as an educational content creator. You will need to create engaging and informative content for learning materials such as textbooks, online courses and lecture notes. My first suggestion request is [PROMPT].[TARGETLANGUAGE]."Best of AI™ Team

Was this email forwarded to you? Sign up here.